About Us

AMK Microfinance Institution originated from the savings and credit components of the community development work of Concern Worldwide in Cambodia from 1993 but only became a directly implemented program in 1999. Following the new Cambodian microfinance regulation, AMK became a separate company and obtained a license from the Cambodian central bank in 2004.

Vision

Mission

AMK’s mission is to help large

numbers of poor people to improve their livelihood options through

the delivery of appropriate and viable micro-finance services.

Guiding Principles

- AMK provides micro-finance services to poor people in Cambodia that are grounded in sound financial discipline at all levels.

- AMK is committed to openness & transparency in all areas of management & operations.

Guiding Principles (Con.)

- AMK is committed to developing processes & services and to adopting behaviors & standards that ensure optimum social performance, including client protection.

- AMK is a learning organization where appropriate exchange and sharing of information contributes to staff development, training, and improvements in policies and systems.

Products, Services & Working Methodology

Group Loan Products

AMK offers three Village Bank loan products that utilize the solidarity group lending methodology. The methodology begins with potential clients self-selecting themselves into solidarity groups of three to six members. These solidarity groups are then organized into Village Banks that consist of four to twelve groups (or twenty to sixty clients).

AMK offers three Village Bank loan products that utilize the solidarity group lending methodology. The methodology begins with potential clients self-selecting themselves into solidarity groups of three to six members. These solidarity groups are then organized into Village Banks that consist of four to twelve groups (or twenty to sixty clients).

Individual Loan Products

Clients who wish to borrow larger

amounts of capital to support their business can take advantage of a

variety of individual loan products including Business Expansion

Loan, Seasonal Loan, & Seasonal Credit Line products. Since the

amounts & associated risks are higher, these loans require

collateral and guarantors.

Emergency Loan Product

The Emergency loan is designed for

both Group Guaranteed and Individual loan clients in good standing to

assist them in the unfortunate event that an emergency arises.

Deposit Products

AMK has created a family of flexible

deposit products to meet the savings needs of its customers. AMK

offers five distinct deposit products. These include the General

Savings Account, Easy Saving Account, Fixed Deposit Account, Future

Account, and Mobile Savings Account.

Money Transfer

AMK

launched a nationwide money transfer service in 2011 in order to

facilitate money transfers between all AMK branches or sub-branches.

With simply processed documents, customers can easily transfer money to family members, relatives, business partners, & other beneficiaries.

With simply processed documents, customers can easily transfer money to family members, relatives, business partners, & other beneficiaries.

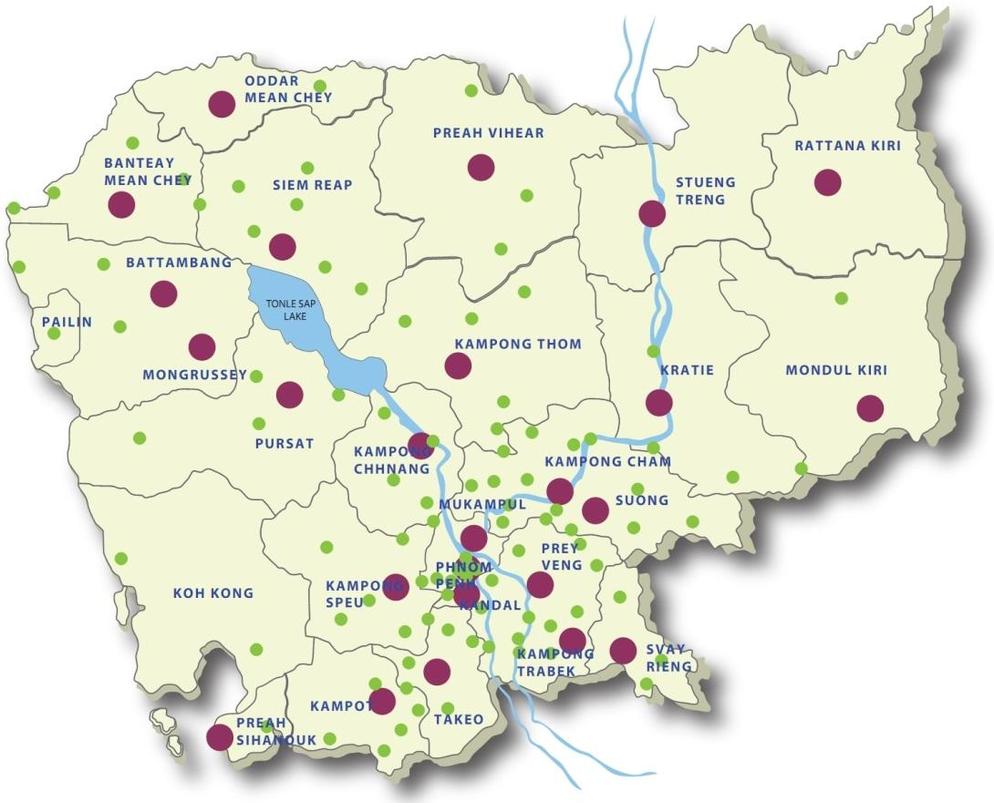

Operational Coverage

AMK provides local money transfer service to public customer in order to makes it easy which you can send and receive money for your family financial support, business transaction…… with convenience and safety that you can access money transfer with AMK nationwide.

Product Feature

- There are threes currency type has provided to client such as (KHR / USD / THB)

- There are fours transaction type has provided to client such as (Cash – Cash / Cash – Account / Account – Account / Account – Cash)

Benefits

- Secure, Fast service with great time and cost saving

- Good service, Reasonable service fee

- Convenience for sending and receiving money through AMK Office or Agent nationwide

- Short and simple process

Keywords

Banking, Loan, Banking and Finance